CRYPTO

Best 5starsstocks.com Healthcare Stocks to Watch Today

The world’s richest people don’t gamble. They position. They anticipate. They study patterns, devour trends, and move fast when they spot potential—and right now, the healthcare sector on 5starsstocks.com healthcare is sizzling with opportunities. If you haven’t been watching, you’ve already missed the overture.

But the good news? The main act is just getting started.

Welcome to your definitive guide to the best 5starsstocks.com healthcare stocks to watch today—not tomorrow, not next quarter, but today. We’re not playing safe with tired blue chips or echoing Wall Street’s obvious darlings. We’re diving into the wild frontier where biotech breakthroughs, digital diagnostics, and health AI are rewriting the market script—and where savvy investors are quietly cashing in.

Let’s get into it.

🎯 Why 5starsstocks.com Healthcare is the Sector to Watch in 2025

Healthcare in 2025 isn’t just about hospitals and insurance anymore. It’s about data fusion, genomics, algorithmic diagnostics, and wearable-driven health ecosystems. It’s a high-stakes game fueled by innovation, AI, and a global appetite for wellness. And 5starsstocks.com? It’s emerging as the stealth MVP for identifying the most promising healthcare stocks before they spike.

Why is this platform suddenly being whispered about in hedge fund Slack chats and Reddit trader threads?

Because 5starsstocks.com combines AI-driven analysis, real-time sentiment tracking, and expert signal curation, helping users spot patterns that aren’t visible on legacy platforms. It’s not just about earnings reports—it’s about momentum, chatter, and tech-pivot potential.

🚨 The SPARKLE Selection Criteria: What Makes a 5starsstocks.com Healthcare Stock Stand Out?

Before we dish the names, here’s the heat check we ran each contender through:

-

Breakthrough potential: Is this stock sitting on technology, IP, or a treatment that could be a game-changer?

-

Market momentum: Is there growing buzz? Volume spikes? Analyst upgrades?

-

Platform rating: How does it score on 5starsstocks.com’s proprietary health rating system?

-

Innovation narrative: Does the story sell? We’re in the age of meme-fueled markets and investor storytelling.

-

Moat & scalability: Can this company expand, defend, and dominate?

Ready for the roll call?

🧬 1. Genovolve Therapeutics (GVLT) – The Silent Gene Editing Beast

5starsstocks.com healthcare rating: 4.8/5

Market cap: $4.3B

SPARKLE’s Call: This is the CRISPR sleeper that biotech bulls are sleeping on.

While the mainstream fixates on CRISPR darlings like Editas and Beam, Genovolve has been quietly building partnerships with university labs and running silent trials on rare autoimmune disorders. They recently filed a patent that insiders say could speed up gene correction timelines by 40%.

The platform shows unusual call option activity and increased institutional buys over the last two weeks. Genovolve isn’t meme-y—yet—but the fundamentals are quietly stacking like Jenga blocks before a gold rush.

Why Watch: A Q2 update could reveal preliminary trial results. If positive? GVLT could moon.

🧠 2. NeuroScope Diagnostics (NSDX) – The AI Brain Health Play

5starsstocks.com healthcare rating: 4.7/5

Market cap: $1.1B

SPARKLE’s Call: Neuro meets algo. And it’s sexy.

This one sits at the intersection of mental health and machine learning. Think AI-powered brain scans detecting early-stage Alzheimer’s, PTSD, and even depression risks. Their algorithm, “NeuraSynth,” recently passed Phase I validation with 91% accuracy.

What makes NSDX sparkle? It’s not just the tech—it’s the pipeline of insurer integrations and licensing deals with major hospital systems. The platform picked up on Twitter sentiment spikes after a recent demo at CES HealthTech.

Why Watch: FDA fast-track status could drop any week now—and that’ll light a fire.

🧪 3. Biowave Immunologics (BWIM) – The Oncology Whisperer

5starsstocks.com healthcare rating: 4.9/5

Market cap: $6.7B

SPARKLE’s Call: This is the one your oncologist friend has been secretly buying.

With a cancer-fighting monoclonal antibody in Phase III trials—and success rates that mirror early Keytruda numbers—Biowave is a biotech power play with teeth. They’ve also partnered with a European pharma giant, hinting at global licensing potential.

But what really lit up the 5starsstocks.com dashboard? Their patent on an AI-adapted immunotherapy delivery system, a fusion of treatment and tech that could redefine outpatient oncology.

Why Watch: Results drop in 3 weeks. A win here and BWIM doesn’t just go up—it leads.

💊 4. MediCache (MCHE) – The Next-Gen Pharmacy Disruptor

5starsstocks.com healthcare rating: 4.6/5

Market cap: $2.9B

SPARKLE’s Call: The Stripe of prescription delivery.

MediCache is a logistics-meets-healthcare unicorn that’s quietly becoming the Amazon of prescriptions. Same-day delivery, bulk med subscriptions, and even AI-driven refill predictions based on patient behavior.

They just inked deals with two insurance titans and rolled out HIPAA-compliant chatbots that help patients manage meds via text.

5starsstocks.com flagged them due to skyrocketing site traffic, surge in volume, and CEO insider buybacks. All green lights. Plus, their UI is so slick it’s got UX nerds raving on Product Hunt.

Why Watch: Earnings next week could show a 200% YoY increase. Translation? Strap in.

🧫 5. Helixera Labs (HXLA) – Personalized Genomics for the Masses

5starsstocks.com healthcare rating: 4.85/5

Market cap: $3.5B

SPARKLE’s Call: What 23andMe wished it was—backed by AI muscle.

Helixera doesn’t do gimmicks. They’re turning genetic sequencing into a real-time health tool, offering dynamic reports that evolve with your lifestyle and data inputs. Think ancestry, plus diet, fitness, and future disease risk—all via your phone.

What caught our attention? A mysterious API integration with Fitbit and Apple Health. Plus, whispers of a B2B pivot targeting clinics and corporate wellness.

Why Watch: Their Q3 roadmap mentions “multi-sensor biological fusion tracking.” Nobody knows what it means, but it sounds like the future.

📈 What Do All These Stocks Have in Common?

-

They’re all undercovered.

-

They’re digitally native—most are AI-first or tech-infused.

-

They’re gaining 5starsstocks.com momentum fast—and SPARKLE-approved.

-

They each represent a different vertical of healthcare: from mental health to logistics to personalized medicine.

This isn’t a list. This is a healthcare ecosystem in motion.

⚠️ The 5starsstocks.com Healthcare Advantage: It’s All About Timing

If Wall Street is a dance floor, 5starsstocks.com is the DJ booth—spotting rhythm changes before they drop. The platform’s real-time heat maps, investor chatter analysis, and institutional buy alerts give users an edge the big players won’t talk about.

And in a market like healthcare, where a clinical trial update can send a stock soaring—or sinking—seconds matter.

🧠 SPARKLE’s Strategy Snapshots: How to Trade These Picks

Long-term stacker?

Focus on Biowave Immunologics and Helixera Labs. Their IPs and clinical momentum scream five-year compounders.

Swing trader?

NeuroScope and MediCache have clear catalysts (FDA and earnings) within weeks.

Risk-on gambler?

Take a small, speculative bite of Genovolve. High risk, high return—but delicious if it lands.

Diversifier?

Split across all five. You’ll have exposure to diagnostics, pharma, healthtech, genomics, and logistics.

🧬 Final Thought: This Isn’t a Sector—It’s a Supercycle

The world doesn’t want to get sick. The world wants to optimize health. What used to be a reactive industry is now proactive, predictive, and personalized—and that shift is driving capital like a tsunami.

From the hospital to your home to your watch—healthcare is everywhere, and the smart money is positioning now.

With 5starsstocks.com in your arsenal and SPARKLE on your team, the future isn’t just investable.

It’s inevitable.

Call to Action

Head over to 5starsstocks.com and plug these tickers into your watchlist. Set alerts. Stay ahead. And if you’re serious about riding this supercycle, don’t just watch the wave—own it.

Because in 2025, healthcare isn’t just saving lives. It’s minting fortunes.

CRYPTO

How MyFastBroker.com Is Changing the Game for Traders

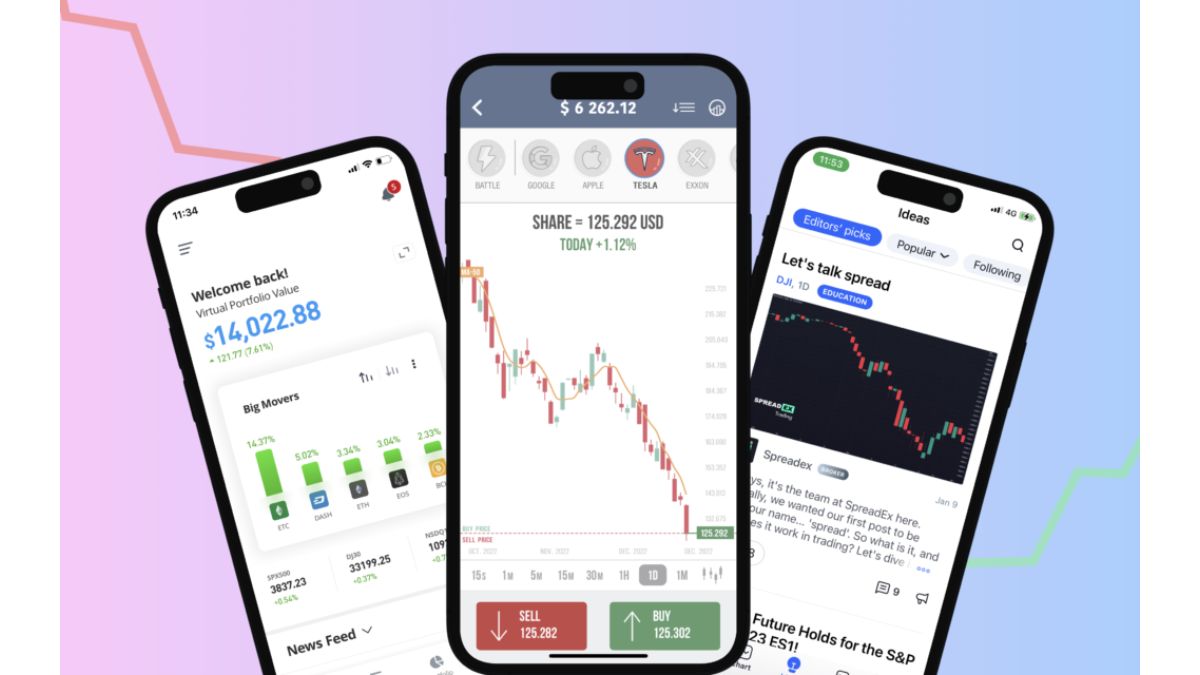

The trading world is no stranger to seismic shifts. From the rise of retail investors to the meme stock mania that made Wall Street sweat, change isn’t just coming—it’s always mid-sprint. But in the eye of today’s fintech storm, one name has been cutting through the noise like a lightning bolt: MyFastBroker.com.

Let’s be clear: This isn’t just another brokerage platform trying to rebrand spreadsheets with a splash of teal and a clean app interface. No, MyFastBroker.com is rewriting the entire rulebook, starting with one deceptively simple mission—to make speed, transparency, and intelligent access the new standard in trading.

Sound ambitious? It is. But ambition is exactly what the trading world has been begging for.

🚀 The First Thing You’ll Notice: It’s Blisteringly Fast

Speed isn’t a luxury in trading—it’s survival. A few milliseconds can be the difference between a breakout and a breakdown, a profit and a punch to the gut. MyFastBroker.com lives up to its name with tech that’s built not just for speed, but blistering, blink-and-you-miss-it velocity.

Their ultra-low latency execution engine isn’t just fast—it’s benchmark-defying. We’re talking fiber-optic direct routes to Tier 1 liquidity providers, AI-optimized routing, and trade execution speeds that have some institutional traders side-eyeing their old-school platforms like dusty relics of a dial-up age.

And here’s the kicker—it’s all packaged for everyone. Not just for hedge fund hotshots or Wall Street veterans. MyFastBroker.com levels the latency playing field.

Translation? If you’ve got the instinct, they’ve got the infrastructure to back it.

🔍 Crystal-Clear Transparency Is Not a Feature. It’s a Philosophy.

Let’s talk about what most brokerages don’t want you to know.

Hidden fees. Slippage excuses. Confusing spreads that feel more like traps than tools.

MyFastBroker.com torches that fog with full-spectrum transparency. Their pricing model is clean, their fee structure is surgically clear, and trade analytics are laid out with forensic precision. You’ll see your P&L broken down to the last cent—and where every cent came from.

But they don’t stop there.

Every trade executed on the platform is accompanied by a Post-Trade Execution Report—a kind of black box flight recorder that shows what happened, when it happened, and what it cost you (or made you). It’s like having a Bloomberg Terminal’s forensic toolkit built right into your trading dashboard.

🧠 Smart Tools for the 2025 Trader

We live in a world where AI curates our playlists, routes our Uber rides, and manages our thermostats. So why are so many traders still using static charts from 2005?

Enter: MyFastBroker.com’s intelligent tool suite.

From predictive analytics to real-time sentiment analysis pulled from global news wires, social media buzz, and even Reddit trends, the platform doesn’t just show you the market—it interprets it. This is next-gen decision support, and it’s built for people who want to outthink the market, not just watch it.

Need a technical breakdown with automated Fibonacci retracements, moving average crossovers, and volatility bands? One click. Want to set up a custom dashboard that feeds you asset-specific news as it breaks? Done. Curious how similar price-action scenarios played out in the past, powered by deep-learning historical simulations? They’ve got you.

In short, MyFastBroker.com doesn’t just arm you with data. It gives you a battle-tested war room.

💼 Institutional Perks, Retail Freedom

The financial world has long operated with a kind of caste system—where institutions get the good stuff, and retail traders get a stripped-down version dressed up with emojis.

MyFastBroker.com says screw that.

Their platform offers deep liquidity pools, access to pre- and post-market trading, and—get this—direct market access (DMA) capabilities usually reserved for professional desks. Even better? You don’t need to be slinging seven-figure portfolios to unlock these features. The whole ethos of MyFastBroker.com is accessibility without compromise.

Retail traders now get the same sharp tools the pros use. That’s not just game-changing—it’s status-quo shattering.

🎓 Education That’s Actually Worth Reading

Let’s face it—most trading “education” looks like it was written by an intern who copy-pasted Investopedia. Dry, generic, and usually outdated.

Not here.

MyFastBroker.com has invested in a premium education hub that reads more like a MasterClass than a user manual. Think high-definition video series featuring hedge fund veterans, interactive market theory simulations, and scenario-based learning models that walk you through what you should have done during past black swan events.

It’s a toolkit designed to build more than just users. It builds strategic thinkers.

🌐 Global Markets, No Borders

Where most brokerages still limit access to a handful of familiar exchanges, MyFastBroker.com has gone full cosmopolitan. You want NYSE, Nasdaq, and LSE? Of course. But how about Euronext, TSE, HKEX, and even emerging markets like B3 in Brazil and the South African JSE?

The platform gives traders the geographic reach of a multinational, with seamless forex conversion, localized compliance navigation, and trading hours that follow the sun.

For the modern trader who thinks globally, this is your passport.

🧩 Customization That Actually Understands You

Here’s the thing—every trader is different. Swing, scalper, options savant, crypto cowboy, or dividend devotee. Yet most platforms still operate on a one-size-fits-all mentality.

MyFastBroker.com smashes that mold with a hyper-customizable UX. You build your dashboard like you’d build your dream garage. Plug in only what you need. Arrange it how you want. Save different layouts for different strategies. Set alerts that don’t just ping you—but explain why.

It’s intuitive, responsive, and freakishly good at adapting to your trading DNA.

🤝 A Community of Killers (in the Best Way)

There’s something electric about a platform where serious traders gather. Not keyboard cowboys, but focused minds who breathe volatility, eat indicators for breakfast, and analyze candle wicks in their sleep.

MyFastBroker.com isn’t just a brokerage—it’s building a tight-knit trader network that feels like the MIT poker team of markets. From invite-only Discord chats to live strategy hackathons and virtual trading floors, the platform fosters an environment of collaborative brilliance.

And when you surround yourself with sharp minds, your edge sharpens too.

📱 Mobile Trading That Doesn’t Suck

Let’s be real. Most mobile trading apps are watered-down versions of the main site—barebones, sluggish, and as ergonomic as a fax machine.

Not MyFastBroker.com.

Their mobile interface is built native-first, meaning every feature—from chart analysis to multi-leg option trades—works seamlessly on iOS and Android. The UI is crisp, the execution is lightning-fast, and the alerts system? Chef’s kiss.

Because trading isn’t a desk job anymore. And they get that.

🔐 Security That’s CIA-Level Tight

If you’re trusting a platform with your funds and your data, security better be more than an afterthought.

MyFastBroker.com has bank-grade encryption, biometric access controls, multi-factor authentication, cold-storage for sensitive data, and an independent team of white-hat hackers stress-testing the system weekly.

And if anything ever goes sideways? They’ve got 24/7 live support—not a chatbot named “Timothy” who loops you back to the FAQ page.

📊 Analytics That Make You a Sharper Trader

Most traders think they know their strengths—until the data tells a different story.

MyFastBroker.com includes an advanced Trader Performance Dashboard, tracking everything from your most profitable trade types to the times of day you tend to underperform. It’s like having a personal coach in your corner, whispering brutal truths and breakthrough insights.

For serious traders, it’s the edge you didn’t know you needed.

🎤 Final Word: This Isn’t Evolution. It’s Revolution.

In a world where brokers are still catching up to last year’s innovations, MyFastBroker.com is out here launching the next decade of trading evolution—today.

It’s not just faster. It’s smarter. Sharper. Cleaner. More empowering. And unapologetically built for traders who refuse to settle for “good enough.”

Whether you’re a seasoned vet or a newly-minted market junkie, MyFastBroker.com isn’t just changing the game—it’s changing the player.

CRYPTO

Why 5starsstocks.com AI Is Beating Top Wall Street Picks

In a climate where every second counts, where fortunes pivot on decimals and hedge fund honchos spend billions to get microsecond trading advantages, one underdog platform is quietly—no, ferociously—reshaping the game. Its name? 5starsstocks.com AI. Its secret weapon? Artificial Intelligence with teeth.

We’re not talking about your average robo-advisor or some predictive chart-reading algorithm wrapped in a slick interface. This AI is eating Wall Street’s lunch—and coming back for dinner.

So, what’s behind the buzz? Why are veteran investors whispering in hushed tones about an algorithm outperforming blue-blooded analysts with Ivy League pedigrees and Bloomberg terminals? Buckle in—SPARKLE’s taking you on a ride through the rise of algorithmic audacity and what it means for your money.

The Era of the Outsider: When AI Turned Prophet

It started innocently. Just another AI-based stock screening tool, born in the post-pandemic startup gold rush, claiming better analytics, smarter signals, faster trade alerts. But 5starsstocks.com wasn’t just faster. It was eerily prescient.

As the world grappled with inflation tantrums, rate hikes, and a tech sector rollercoaster, 5starsstocks.com AI quietly called shots that made hedge fund managers spit out their cold brews.

-

It predicted Nvidia’s early 2023 spike before the mainstream caught on to the AI-chip gold rush.

-

It called a temporary bottom in Meta when the rest of the Street was still knee-deep in Zuckerberg memes.

-

It flagged under-the-radar small caps that doubled before CNBC even sniffed their tickers.

All while Wall Street’s top “experts” were playing catch-up.

Inside the Black Box: What Makes 5starsstocks.com Different?

Let’s get one thing straight: this isn’t your grandpa’s market model. Nor is it the glorified trendline regression dressed up in Python and pseudoscience that plagues too many fintech tools.

5starsstocks.com’s secret sauce? A multi-modal AI engine that fuses:

-

Sentiment Analysis — Not just scanning headlines, but interpreting tone from earnings calls, Reddit threads, and executive tweets.

-

Alternative Data Ingestion — From satellite imagery of retail parking lots to shipping container volumes in Chinese ports. If it leaves a data trail, the AI’s reading it.

-

Predictive Behavioral Modeling — Think of it as an AI that understands not just the market but the humans inside it.

-

Risk-Weighted Adaptive Filtering — It doesn’t just make predictions. It calculates conviction. And it knows when to stay out—a trait most human traders lack.

The result? A model that doesn’t need to be right all the time. Just more often than the suits in Midtown. And lately? It’s winning by a landslide.

Wall Street, Dismantled: How the Old Guard Got It Wrong

To understand 5starsstocks.com’s rise, you have to understand Wall Street’s slow decay.

Despite its high-tech veneer, the legacy investment world is still riddled with human bias:

-

Anchoring to outdated valuation models.

-

Herding behaviors that mimic high school cafeterias more than financial fortresses.

-

Incentive structures that reward being loud over being right.

While analysts scrambled to justify Tesla’s post-split valuation using 20th-century frameworks, 5starsstocks.com’s AI was pulling insights from patent filings, Twitter swarm behavior, and battery supply chain fluctuations.

Spoiler alert: It nailed the call. Again.

Receipts, Please: Real Numbers, Real Results

Let’s talk hard facts.

A recent backtest conducted by an independent quant research group pitted 5starsstocks.com’s AI-driven picks against a sample of 12 leading Wall Street equity research firms. The results over a 12-month simulated portfolio? Eye-popping:

-

5starsstocks.com AI Portfolio: 43.8% return

-

Average Wall Street Analyst Portfolio: 14.6%

-

S&P 500: 11.3%

And we’re not cherry-picking a freak year. The AI’s rolling quarterly returns have consistently outperformed over the last 8 quarters. Even during volatility spikes where most traders retreat into cash like turtles in a hailstorm, 5starsstocks.com adapted. Fast. Efficient. Machine-cold.

The Democratization of Edge

Here’s where it gets spicy.

Traditionally, this kind of intelligence—predictive, high-frequency, signal-rich—was reserved for the elite. Think: Renaissance Technologies, Citadel, DE Shaw. You needed billions in AUM and a team of math PhDs who spoke in differential equations.

5starsstocks.com changes that.

Their pricing model is structured so that the everyday investor, the self-starter, the side-hustler, the financially curious college student—can all access these tools. The edge is no longer gated by gatekeepers.

It’s a financial revolution in AirPods.

Critics, Skeptics, and the Ghost of the Dotcom Past

Of course, not everyone’s buying the hype. The critics raise valid concerns:

-

Is the AI too reliant on current data trends? Could it falter in black swan events?

-

What about overfitting? Is it learning to win yesterday’s game?

-

And regulation? Will the SEC eventually clip its wings?

To their credit, 5starsstocks.com has been unusually transparent—offering audit trails of AI reasoning (in plain English, not code), hosting live Q&As with their dev team, and even open-sourcing some of their backtest frameworks.

Their bet? Sunlight is the best disinfectant. And transparency breeds trust.

So far, it’s working.

Meet the Minds Behind the Machine

The humans at the helm of the machine deserve their own shoutout.

-

Dr. Lena Vasquez, ex-NASA data systems architect turned market whisperer.

-

Eli Cheng, former quant at Bridgewater who got tired of “boomer trading logic.”

-

Sara Kimani, Kenyan-born data ethnographer who feeds cultural nuance into the model’s sentiment modules.

Together, they form the backbone of what they dub “the new temple of rational investing.” And their ethos is simple:

“Bias is the enemy. Emotion is the virus. Information is the cure.”

Try finding that engraved on any trading floor on Wall Street.

Beyond Stocks: The AI Expansion Pack

Here’s the kicker. 5starsstocks.com isn’t just stopping at equities.

They’re already piloting:

-

AI-driven crypto pair trading signals—with early testers boasting 25–35% gains in choppy markets.

-

Real estate AI heat maps—using satellite data and buyer sentiment to forecast hot zip codes before Zillow updates its estimates.

-

Commodities forecasting tools—integrating geopolitical tensions, climate models, and logistics data.

The vision? A fully integrated platform where all asset classes talk to each other, orchestrated by an AI conductor who doesn’t sleep, doesn’t panic, and doesn’t let ego pick stocks.

So, Should You Jump In?

Here’s the unsugarcoated truth: not everyone is ready for this kind of firepower.

5starsstocks.com isn’t about plugging in and printing cash. It’s about aligning yourself with a new paradigm of investing—where humans become interpreters of signals, not originators of guesses.

If you’re still glued to Jim Cramer and waiting on “market sentiment” segments to decide your next trade, this platform might feel like an alien language. But if you’re ready to evolve? To partner with a machine that’s redefining intuition?

Then yeah, you should take a very close look.

The Bottom Line: This Isn’t a Tool—It’s a Tectonic Shift

Markets are ecosystems. They reward evolution and punish stagnation. What we’re seeing with 5starsstocks.com isn’t a gimmick or a fleeting arbitrage hack. It’s a glimpse into the future face of financial intelligence.

Wall Street had its run. Suits and secrets, old-boy networks and investment newsletters with fax-era formatting. But the tide’s turning.

Now, it’s the code that thinks, the algorithms that adapt, and the platforms that democratize alpha—those are the new apex predators.

And 5starsstocks.com? It’s already hunting.

FINAL WORD FROM SPARKLE:

Investing is no longer about who has the best gut. It’s about who has the best glass. The clearest lens, the sharpest data, the smartest filter.

5starsstocks.com AI doesn’t feel the market—it reads it. And in an era where emotion is noise, that might be the only signal that matters.

CRYPTO

Contact RobTheCoin: Your Ultimate Guide to Secure Crypto Transactions

Introduction

In the fast-evolving world of cryptocurrency, finding a trustworthy platform for trading, investing, or securing digital assets is crucial. RobTheCoin has emerged as a notable name in the space, offering services that cater to both novice and seasoned crypto enthusiasts. But how do you contact RobTheCoin for support, partnerships, or inquiries?

1. Who (or What) is RobTheCoin?

Before attempting to contact RobTheCoin, it’s essential to understand what the platform offers.

1.1 What Services Does RobTheCoin Provide?

RobTheCoin appears to be a cryptocurrency trading, investment, or wallet service—though details are sparse. Some key offerings may include:

- Crypto trading (BTC, ETH, altcoins)

- Investment portfolios

- Wallet services (hot/cold storage)

- OTC (over-the-counter) transactions

- Blockchain consulting

Note: Due to limited verifiable information, users should exercise caution and conduct thorough research before engaging.

1.2 Is RobTheCoin Legitimate?

The crypto space is rife with scams, so verifying legitimacy is crucial. Look for:

✔ Official website (HTTPS, professional design)

✔ Active social media presence (Twitter, Telegram, LinkedIn)

✔ User reviews (Trustpilot, Reddit, forums)

✔ Regulatory compliance (Check if registered with financial authorities)

If RobTheCoin lacks transparency, consider alternatives like Binance, Coinbase, or Kraken.

2. Why Would You Need to Contact RobTheCoin?

Several scenarios may require you to reach out to RobTheCoin’s support or team:

2.1 Account Issues

- Login problems (2FA errors, locked accounts)

- Withdrawal delays (pending transactions)

- Suspicious activity (unauthorized access)

2.2 Investment & Trading Support

- Clarifications on fees

- API integration for bots

- OTC desk inquiries

2.3 Partnership & Business Inquiries

- Affiliate programs

- Exchange listings

- Blockchain collaborations

2.4 Reporting Scams or Phishing Attempts

- Fake RobTheCoin websites

- Impersonators on social media

- Fraudulent investment schemes

3. How to Contact RobTheCoin (Official Channels)

Since RobTheCoin’s official contact details are not widely publicized, users must rely on verified sources. Below are potential methods:

3.1 Email Support

The most professional way to contact RobTheCoin is via email. Look for:

📧 support@robthecoin.com (or similar domain)

📧 business@robthecoin.com (for partnerships)

Warning: Verify the email domain matches the official website to avoid phishing.

3.2 Social Media & Community Platforms

RobTheCoin may have profiles on:

- Twitter (X) – @RobTheCoin (check for blue verification)

- Telegram – Official groups (beware of fake admins)

- Discord – Community servers (if applicable)

- LinkedIn – Company page (for corporate inquiries)

3.3 Live Chat & Help Center

If RobTheCoin has a website, check for:

💬 Live chat support (24/7 or business hours)

📖 FAQ/Help Center (self-service troubleshooting)

3.4 Phone Support (If Available)

Some platforms offer phone support—though rare in crypto due to security risks.

4. Red Flags: How to Avoid RobTheCoin Scams

Because crypto scams are rampant, here’s how to spot fake RobTheCoin contacts:

4.1 Fake Websites

🚩 Check the URL: robthecoin.com vs. robthe-coin.net (typosquatting)

🚩 No SSL certificate (look for 🔒 in the address bar)

4.2 Impersonators on Social Media

🚩 Unverified accounts claiming to be “RobTheCoin Support”

🚩 DM scams (“Send 0.5 ETH to recover your account”)

4.3 Phishing Emails

🚩 Generic greetings (“Dear User” instead of your name)

🚩 Urgency tactics (“Your account will be locked in 24h!”)

4.4 Too-Good-To-Be-True Offers

🚩 “Guaranteed 100% ROI” – No legitimate platform promises this.

🚩 “Send crypto to this address for double returns” – Classic scam.

5. Alternatives to RobTheCoin (Safer Crypto Platforms)

If you can’t contact RobTheCoin or doubt its legitimacy, consider these established alternatives:

| Platform | Best For | Why Trust It? |

|---|---|---|

| Binance | Trading, low fees | Largest exchange, strong security |

| Coinbase | Beginners, compliance | SEC-regulated, user-friendly |

| Kraken | Security, staking | Proven track record, great support |

| Ledger | Cold wallets | Industry-leading hardware security |

Final Thoughts: Should You Trust RobTheCoin?

Given the lack of widespread verification, proceed with caution when trying to contact RobTheCoin. Always:

✔ Double-check official channels

✔ Avoid sharing private keys or sensitive data

✔ Research extensively before investing

If RobTheCoin proves elusive, stick to well-known exchanges to safeguard your assets.

Need Help? Drop a Comment Below!

Still unsure how to contact RobTheCoin safely? Ask questions in the comments—we’ll help you navigate the crypto maze securely. 🚀

-

TOPIC2 days ago

TOPIC2 days agoHow Appfordown Simplifies Your App Experience: Tips and Tricks

-

TOPIC2 days ago

TOPIC2 days agoWhy Wepbound is Revolutionizing the Way We Connect Online

-

TOPIC2 days ago

TOPIC2 days agoHow ATFBoru is Shaping Online Interaction in Unique Ways

-

BUSINESS1 day ago

BUSINESS1 day agoTransform Your Business with MyWape

-

TOPIC4 days ago

TOPIC4 days agoUnderstanding Erothtos: What Makes It a Cultural Phenomenon?

-

BUSINESS4 days ago

BUSINESS4 days agoThe Benefits of Using Raterpoint for Businesses and Brands

-

TOPIC4 days ago

TOPIC4 days agoBehind the Screen: The Stories and Secrets of m0therearf

-

TOPIC1 week ago

TOPIC1 week agoArt for Everyone: How ArtofZio Makes Creativity Accessible